Understanding United Healthcare Vision Coverage

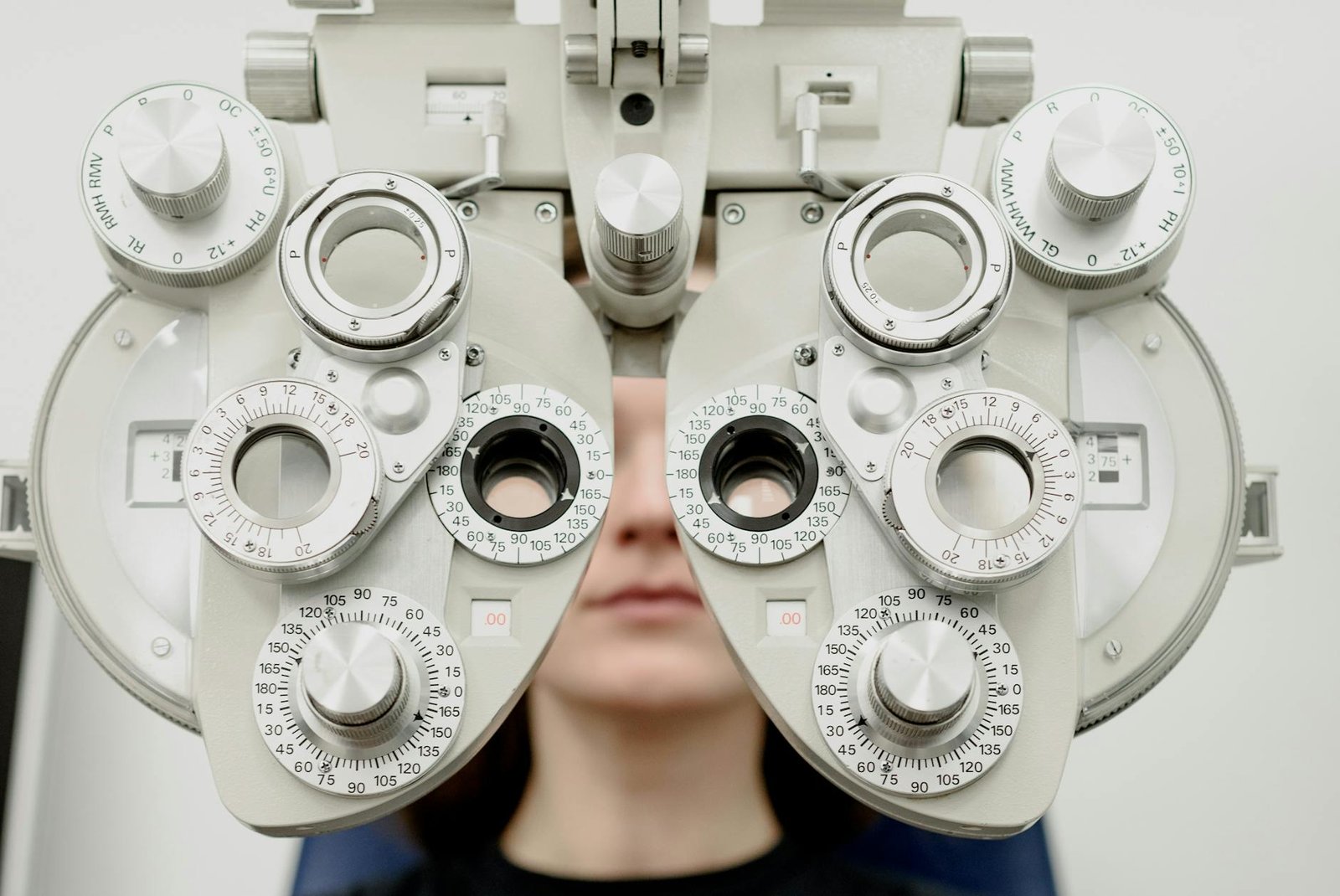

United Healthcare offers comprehensive vision coverage plans to help individuals maintain their eye health and vision needs. Understanding the basics of United Healthcare Vision Coverage can help you make informed decisions about your eye care. Let’s explore the overview of United Healthcare Vision Coverage and the benefits and services covered.

Overview of United Healthcare Vision Coverage

United Healthcare Vision Coverage provides access to a wide range of eye care services, including routine eye exams, prescription glasses, contact lenses, and discounts on additional vision care products. The coverage aims to promote regular eye care and early detection of eye conditions, ensuring optimal vision health.

United Healthcare Vision Coverage is available through various plans, including employer-sponsored plans, individual plans, and Medicare Advantage plans. The specifics of the coverage may vary depending on the plan you choose, so it’s essential to review the details of your specific plan to understand the extent of your coverage.

Benefits and Services Covered

United Healthcare Vision Coverage typically includes the following benefits and services:

-

Routine Eye Exams: Regular eye exams are an important part of maintaining good eye health. These exams can help detect vision problems, eye diseases, and other underlying health conditions. United Healthcare Vision Coverage often includes coverage for routine eye exams, allowing you to receive comprehensive eye care.

-

Prescription Glasses: If you require prescription glasses, United Healthcare Vision Coverage can help offset the cost. The coverage typically includes allowances for frames, lenses, and lens enhancements. Some plans may also offer discounts on premium lens options, such as progressive lenses or anti-reflective coatings.

-

Contact Lenses: For individuals who prefer contact lenses, United Healthcare Vision Coverage often includes benefits for contact lens fittings and evaluations, as well as coverage for contact lenses themselves. The coverage may include both traditional contact lenses and specialty lenses, such as toric lenses for astigmatism or multifocal lenses.

-

Discounts and Additional Vision Care Products: United Healthcare Vision Coverage often provides discounts on additional vision care products, such as non-prescription sunglasses, lens enhancements, and other vision accessories. These discounts can help you save money while taking care of your eye health.

It’s important to note that the specific benefits and coverage details may vary based on your plan and location. To get a complete understanding of your United Healthcare Vision Coverage, it’s recommended to review your plan documents or contact United Healthcare customer service. For more information on other United Healthcare plans, such as dental or Medicare Advantage plans, check out our articles on United Healthcare Dental Plans and United Healthcare Medicare Advantage.

Understanding the overview and benefits of United Healthcare Vision Coverage can help you make the most of your vision care benefits. Regular eye exams, access to prescription glasses and contact lenses, and discounts on additional vision care products can contribute to maintaining good eye health and clear vision.

How United Healthcare Vision Coverage Works

If you are considering United Healthcare for vision coverage, it’s important to understand how the process works. This section will guide you through the enrollment process, finding in-network providers, and making claims to receive reimbursements.

Enrollment Process

Enrolling in United Healthcare Vision Coverage is a straightforward process. If you are an employee, your employer will provide you with information about the available health benefits plans, including vision coverage. You will have a specific enrollment period during which you can choose to opt-in for vision coverage.

During the enrollment process, you may need to provide certain personal and dependent information, such as names and birthdates. It’s important to carefully review the details of the vision coverage plan, including the benefits and coverage limits, to ensure it meets your needs. If you have any questions or need assistance, you can reach out to United Healthcare’s customer service department for further guidance. For contact information, visit our article on United Healthcare customer service.

Finding In-Network Providers

United Healthcare has a network of vision care providers across the country. To maximize your benefits and minimize out-of-pocket expenses, it is recommended to choose an in-network provider. In-network providers have agreed to a negotiated fee schedule with United Healthcare, resulting in lower costs for covered services.

To find in-network providers, you can visit the United Healthcare website and use their provider search tool. This tool allows you to search for eye doctors, optometrists, and ophthalmologists in your area who accept United Healthcare vision coverage. Simply enter your location and preferred provider type to generate a list of in-network options.

It’s important to note that if you choose to visit an out-of-network provider, your coverage may be limited, and you may be responsible for a higher portion of the costs. Therefore, it’s advisable to confirm the network status of any provider before scheduling an appointment.

Making Claims and Receiving Reimbursements

When you receive covered services from an in-network provider, the provider will typically handle the claims process directly with United Healthcare. They will submit the necessary documentation and billing information on your behalf.

If you visit an out-of-network provider, you may need to file a claim yourself. United Healthcare will require you to complete a claim form and provide supporting documents, such as receipts and itemized bills. Once your claim is submitted, United Healthcare will review the documentation and determine the eligible reimbursement amount based on your coverage.

To ensure a smooth reimbursement process, it’s important to carefully review the claim requirements and submit all requested information accurately and on time. In case you have any questions or need assistance with the claims process, you can contact United Healthcare’s customer service department for guidance.

Understanding the enrollment process, finding in-network providers, and the claims and reimbursement procedures will help you navigate United Healthcare Vision Coverage effectively. By making informed decisions and utilizing the benefits offered, you can ensure that your vision needs are taken care of. For more information on other types of coverage offered by United Healthcare, check out our articles on United Healthcare Medicare Advantage, United Healthcare health savings account, and United Healthcare dental plans.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.